It’s the most wonderful time of the year once again – the Christmas decorations are going up and everyone’s getting into the festive mood. But from troubles with the turkey to accidents on ice, sadly, the festive period gets its fair share of accidents to go along with the joy.

In order to find out just which accidents are most common over the Christmas period, and which British city is the most accident-prone with the tinsel, we decided to ask the nation what their most common accidents were over Christmas.

We asked 1,000 people of all ages, gender, ethnicity, and jobs across the UK to fill in a questionnaire asking them about the injuries they might have suffered over Christmas. With our data in hand, we were able to calculate the most common accidents that occurred and the percentage of people unlucky enough to experience them.

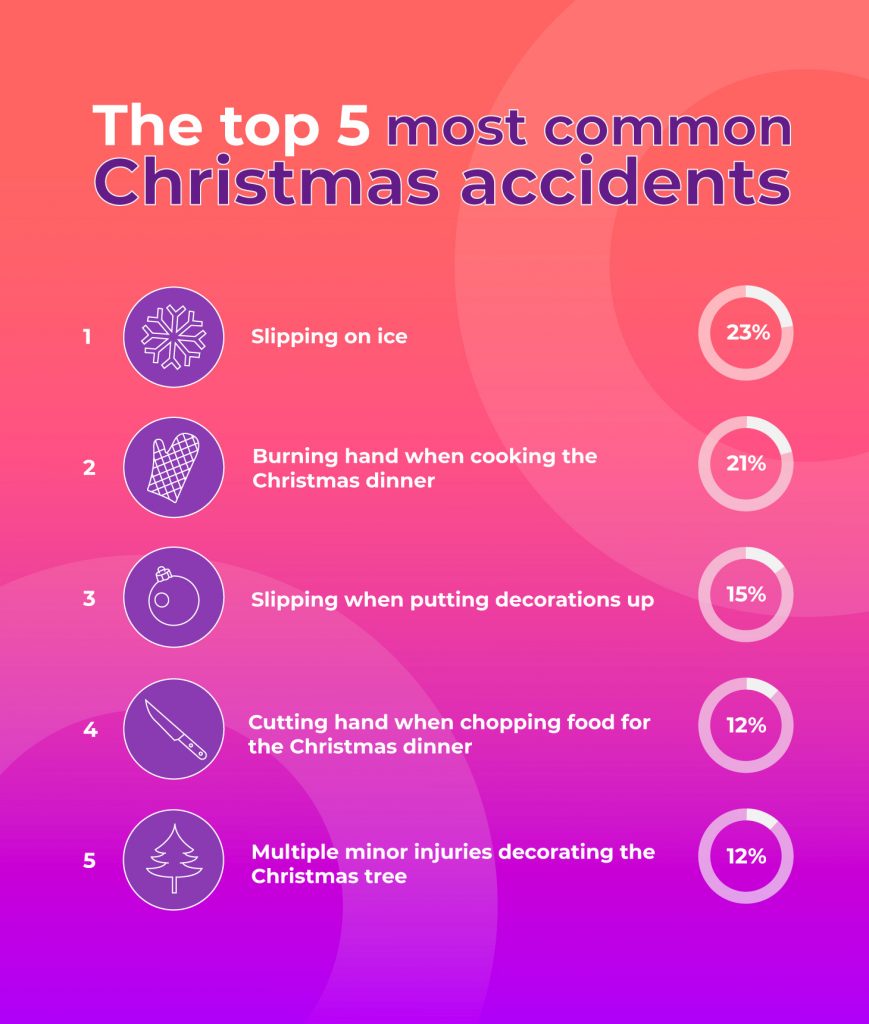

The most common Christmas accidents across the UK

To anyone who’s out and about on those frosty December mornings, one thing everyone keeps an eye out for is ice. Yet we can’t spot every patch, so it might come as little surprise that the top accident found on our survey was slipping on ice.

In fact, 23% of those we surveyed said that they’d suffered an injury due to icy conditions, especially in Belfast and Sheffield where 35% and 33% of those we asked have had some form of slip.

After ice came the accident that no doubt everyone expected, with 21% of those we asked burnt their hand while cooking the Christmas dinner. According to our survey, Londoners are most guilty of this, with a full 30% of them having to run their hand under a cold tap at some point in the day.

Putting up Christmas decorations is often a highlight for many people, but it’s also an activity that takes the third spot on our list. 15% of Brits we asked have suffered some sort of injury as a result of decking the halls. Manchester is the worst culprit for this with 27% of people suffering a decorating related injury in the home, compared to the 23% of Mancunians who slip on ice.

Moving down our list we find that even decorating the Christmas tree can be hazardous, as 12% of those we asked have found out. It would seem that Londoners are particularly prone to this with 20% of them bashing a bauble or tripping on tinsel.

Finally, the fifth most common UK accident to make the cut is injuring yourself in the kitchen while chopping food for Christmas dinner. 11% of those we asked have injured themselves in some way while prepping the veg, particularly in Newcastle and Nottingham where roughly 13% of residents end up accidentally nicking themselves.

Of course, while these might be the top 5 most common accidents suffered, they’re by no means the only ones. 15% of those we asked in Belfast and Birmingham have hurt themselves while wrapping gifts, while 10% of those in Bristol got caught up in the melee of last-minute Christmas shopping. We also saw injuries relating to dancing, attending Christmas parties, and even lighting candles.

Christmas might be fun, but it can also be incredibly stressful

In a lot of cases, accidents that happen at Christmas are just that – accidents. But accidents themselves can be caused by a variety of factors. While it’s important we relax and spend time with the family over the festive season, it’s also important to understand how stressful it can be.

Shockingly, 50% of those we surveyed said they feel much more stressed over Christmas, and 61% said they found themselves rushing to do things – something that only increases the chance of accidents occurring. People in Edinburgh are the most stressed at 64%, but Liverpool is where people are rushing around for those last-minute finishing touches with a staggering 75% of those we surveyed falling into this category.

Many people also find their house is much messier over Christmas. On the whole, 60% of those we asked said the clutter builds up, with 73% of those in Sheffield struggling to find time to tidy up properly. And no part of Christmas is more stressful than the cooking. 45% of those we asked said they feel the pressure of cooking a Christmas dinner and 22% said they burnt the turkey due to everything else going on around them.

Unfortunately, while many of these accidents might seem minor, sometimes they do lead to a trip to the emergency room. While not overly common, 20% of people have had to take a friend or family member to A&E over the Christmas period and 15% of people have been to A&E for one reason or another, with people in Sheffield finding themselves visiting A&E more than any other city.

Christmas is the time of festive celebration and goodwill to all, but we shouldn’t forget that our rush to get everything done can lead to us and those around us getting injured. So, when you’re getting together with the family this year, consider slowing things down and finding more time to unwind. After all, isn’t spending time with the family more important than rushing to make sure everything’s perfect?

Here at The Compensation Experts, we can help you get the compensation you deserve for any personal injuries you suffer. If you’ve been injured over Christmas, either at work or at home, due to someone else’s negligence, get in touch and we’ll see if you’re eligible to make a claim.