Are you looking to invest your money into an investment fund? Here is everything you need to know about unit trusts vs investment trusts, and the difference between a unit trust and an OEIC.

OEIC vs unit trusts: what’s the difference?

When looking to invest your money in funds, you want to be sure that you’re placing it in a fund that is both secure and reliable. The last thing you want to happen is to be mis-sold investment funds.

If you’re looking to invest your money into funds, the two of the most common types of investment funds are known as unit trusts and open-ended investment companies (OEICs). Both these funds share a variety of traits, but they also have some important differences.

There is also a third type of commonly used trust known as an investment trust that you may want to consider if a unit trust or OEIC doesn’t appeal to you.

What are OEICs and unit trusts?

At first glance, there appears to be little difference between OEICs and unit trusts.

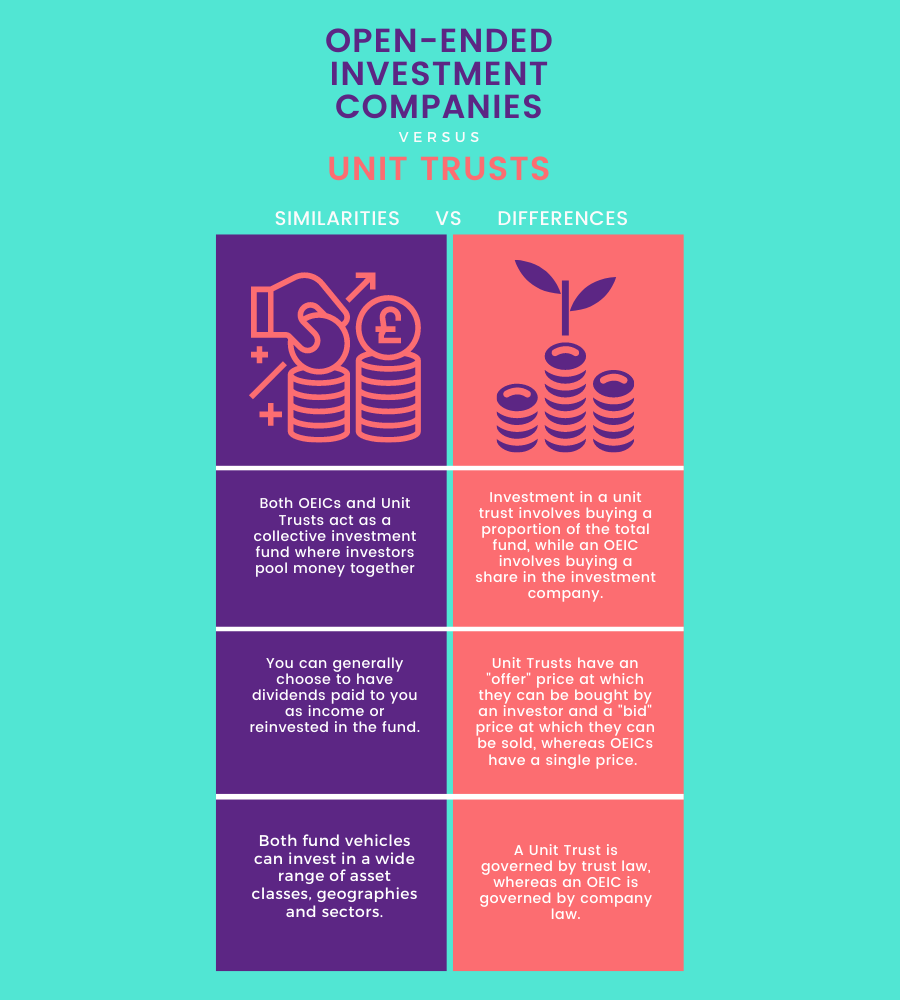

Rather than being an individual fund, both OEICs and unit trusts are what’s known as mutual funds. A mutual fund contains money from multiple different investors and is managed by someone known as a fund manager.

The fund manager takes the invested money and uses it to create a portfolio of investments and assets by investing in bonds or shares from a variety of businesses on the stock market. The total value of these investments is then divided into units, hence the name unit trust, each one being given to one of the fund’s investors. Investors can then exit the fund at any time by selling their unit.

What is an investment trust?

Unlike an OEIC or unit trust, an investment trust is a company that operates as a closed-ended investment fund. While OEICs are fluid in the size of their funds and investments, investment trusts hold a fixed number of shares and will typically retain the same value between the investors when an investor withdraws from the fund.

Investment trusts are seen as longer term investments that require time to fully reap the benefits, being more suited to static investments rather than things such as bonds.

When it comes to the difference between a unit trust and investment trust, if you want an investment you can reach and withdraw easily, a unit trust should be your pick.

OEIC vs unit trusts: similarities

Due to the effectiveness of both open-ended companies and unit trusts as potential investment opportunities, both types of funds have proved to be increasingly popular in recent years.

A large reason for this, and one of the core similarities between the two, is the fact that they can offer a practical and affordable way for clients to diversify their fund portfolio. With shares spread across numerous different asset classes, all managed by a separate individual, there is no pressure to make routine calls on individual stocks and shares to check and monitor their value.

This is particularly true if investors do not have the expertise required to manage stocks and shares professionally. Allowing another individual to handle the buying of units or shares can also provide a much wider spread of investment than an investor could have otherwise achieved with the same amount of money on their own.

In many other respects, unit trusts and open-ended investment companies are the same types of funds. Despite the name difference, they’re both open-ended, and the price of each unit they provide is also dependent on the net asset value of the fund’s overall investment portfolio.

With open-ended investment companies and unit trusts, you can also generally choose to have dividends paid directly to you as income or have it reinvested in the fund if it’s performing well to increase future dividends.

On top of this, both fund vehicles can invest in a wide range of asset classes, geographies, and sectors. The collective nature of unit trusts and OEICs means that the invested money contributed by the number of investors can be pooled together for investment in the stock market.

So, with so many similar aspects between them, you might be wondering why there’s a debate between investing in an OEIC vs unit trust to begin with.

Well, while both fund types might have a lot in common, both also have some pretty major differences.

The difference between unit trusts and OEICs

Without a doubt, when deciding between a unit trust vs OEIC, the main factor that will likely influence your choice will be the pricing of your chosen fund.

Unit trusts have what’s known as an offer price, a price at which an investor can buy into them. But on top of this, they also have what’s known as a bid price. This bid price is the price at which an investor can then sell their unit.

OEICs, on the other hand, have a single price for everything. This often makes OEICs more stable to invest in than unit trusts, as the price gap between a unit trust’s offer and bid cost is typically a 6-7% difference. Charges for an OEIC are simply deducted from the total amount invested.

Essentially, unit trusts come with added cost weight that should be taken into account when deciding between an OEIC vs unit trust.

Investment in a unit trust also involves buying a proportion of the total fund, the unit you are given when you invest in the fund, while an OEIC involves buying an actual share in the investment company. This makes it much clearer as to what you’re investing in when you opt for an OEIC vs unit trusts.

A final, subtle difference between the two is that trust law governs a unit trust, whereas company law governs an OEIC. This means there will be a variety of regulations you’ll need to consider when deciding on which fund to invest in.

Deciding on whether to invest in an investment trust or a unit trust vs OEIC

Now that you know the similarities and differences between an OEIC, unit trust, and investment trust, it’ll be up to you to decide which is more suitable for your needs.

OEICS have substantially increased in popularity in recent years due to their simplified structure, and many unit trusts have converted into OEICS as a result. That being said, unit trusts are still a popular choice. And if you want a long-term investment option, you might want to consider an investment trust.

Regardless of whatever type of fund or trust you’re interested in, it’s a good idea to do your research into investment funds and asset classes so you know what you’re investing into. And if you’re ever unsure about the legality surrounding any type of trust or fund, it’s always a wise idea to approach a qualified solicitor for advice.

Of course, when investing in any type of fund, there is always the risk that you may be mis-sold the investment. Whether it’s mis-sold investment bonds or a stocks and shares ISA, if you believe you’ve been misled on a financial fund investment, you might be able to make a mis-sold investment claim.

Here at The Compensation Experts, we work with solicitors who have years of experience with financial miss-selling claims. They’ll be able to help you tell the difference between OEIC vs unit trusts, as well as walk you through the claims process if you want to make one.